If you’re involved in real estate, then you have probably come across these two important terms: appraisal and inspection. While they may seem to be looking at the same areas of a property, they usually have different goals, explains John Haas of Haas Properties.

Knowing the key differences between an inspection and an appraisal is important, as both can accomplish different tasks. Read on to learn about the difference between a home inspection and a home appraisal.

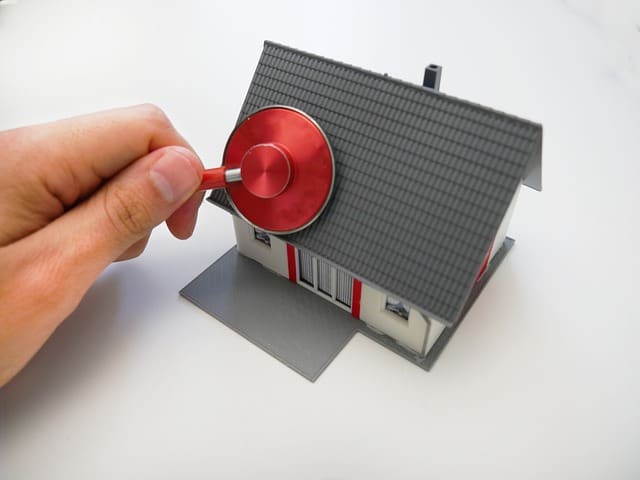

The home inspection process

- Problems with the home’s HVAC system. A home inspector will be looking for defects such as cracked ductwork, combustion gas order, open seams in flues, rust around the unit, or dirty air filters.

- Insect and pest infestations. Termites, certain kinds of beetles, and carpenter ants are among the common wood-destroying insects that can severely damage a home.

- Plumbing related problems. Water problems are a homeowner’s worst enemy. What’s even worse, most plumbing issues are harder to notice until an inspector comes in.

- Problems with the home’s electrical system. Do you know what’s the 4th leading cause of home fires? Well, according to the National Fire Prevention Association, it’s electrical issues. An inspector will, therefore, look for things like GFCI protection, electrical panels, circuit breakers, wiring and splices to ensure they are working as they should.

- Damage to the roof. A strong roof is necessary to protect a home from the elements. As such, an inspector will want to look at things like flashing, shingles, and the attic.

- The home’s structural integrity. One in every four homes will experience structural distress during their lifetime, according to data from over 10,000 structural claims. With this in mind, an inspector will usually check for things like sagging or uneven floors, gaps around window frames, and cracks on the foundation.

Once an inspector has completed the inspection, he or she will then write an inspection report. The amount of time it takes to receive the report usually ranges from a few hours to a couple of days. This, of course, depends on, by and large, the size of the home.

The buyer will then review the report once they receive it and decide whether to proceed with the home buying process or back out from it altogether.

When a home has a problem, buyers often resort to three options. The first is to just continue looking elsewhere. Two, to ask the seller to fix the problems before the purchase. Or three, to ask the seller to price the property accordingly.

The average home inspection cost ranges between $300 and $500.

The Home Appraisal Process

Unlike inspections, however, appraisal reports often take longer than just a couple of hours or days. Often, they will take anywhere between two or three days to a week. The report will typically include:

- The home’s size and condition

- Any improvements the owner has made to the home

- Statements regarding issues like wet basements, cracked foundations, or any other serious structural problems

- Notes about the neighborhood, such as rural acreage, new or established development, and so on

- An evaluation of current market trends in the neighborhood that can affect the home’s value

- An analysis of comparable properties that supports the findings of the appraisal: sketches, photos, and maps

- A run down of how the property’s value was calculated

Once the appraiser has submitted the report, the mortgage lender will then determine how much a buyer can borrow for the property.

Depending on the state, home appraisals typically cost roughly between $250 and $450.

There you have it. The difference between an inspection and an appraisal. If you’re in the market for a new home, make sure you have them both for total peace of mind.

Thank you John for that fantastic guest post from Haas Properties! Knockout Inspections does do home inspections. If you would like more information please contact us!

Do you have questions about Home Inspections? Contact us today: info@koinspections.com or 251-517-4558